Social Security Taxable . under legislation enacted in 1983, the social security trust funds receive income based on federal income taxation of benefits. learn how to calculate your combined income and find out if you have to pay federal income taxes on your social. learn how federal and state taxes affect your social security benefits based on your income level and filing. Federal tax return as an “individual” and your. learn how to determine if your social security benefits are taxable income and how to report them on your tax return. learn how to request federal tax withholding from your social security benefit payment when you apply or change your status. you must pay taxes on up to 85% of your social security benefits if you file a: if your social security income is taxable, the amount you pay will depend on your total combined retirement.

from worksheetrecycled.z5.web.core.windows.net

you must pay taxes on up to 85% of your social security benefits if you file a: learn how to request federal tax withholding from your social security benefit payment when you apply or change your status. Federal tax return as an “individual” and your. if your social security income is taxable, the amount you pay will depend on your total combined retirement. learn how federal and state taxes affect your social security benefits based on your income level and filing. learn how to determine if your social security benefits are taxable income and how to report them on your tax return. under legislation enacted in 1983, the social security trust funds receive income based on federal income taxation of benefits. learn how to calculate your combined income and find out if you have to pay federal income taxes on your social.

Social Security Taxable Amount Worksheet 2022

Social Security Taxable Federal tax return as an “individual” and your. learn how to request federal tax withholding from your social security benefit payment when you apply or change your status. if your social security income is taxable, the amount you pay will depend on your total combined retirement. you must pay taxes on up to 85% of your social security benefits if you file a: learn how to determine if your social security benefits are taxable income and how to report them on your tax return. Federal tax return as an “individual” and your. learn how to calculate your combined income and find out if you have to pay federal income taxes on your social. learn how federal and state taxes affect your social security benefits based on your income level and filing. under legislation enacted in 1983, the social security trust funds receive income based on federal income taxation of benefits.

From ataglance.randstad.com

2023 Social Security Worksheet Printable Calendars AT A GLANCE Social Security Taxable learn how federal and state taxes affect your social security benefits based on your income level and filing. learn how to calculate your combined income and find out if you have to pay federal income taxes on your social. learn how to determine if your social security benefits are taxable income and how to report them on. Social Security Taxable.

From printableliblichts.z13.web.core.windows.net

Taxable Social Security Worksheets 2023 Social Security Taxable if your social security income is taxable, the amount you pay will depend on your total combined retirement. under legislation enacted in 1983, the social security trust funds receive income based on federal income taxation of benefits. you must pay taxes on up to 85% of your social security benefits if you file a: learn how. Social Security Taxable.

From www.youtube.com

How To Calculate, Find Social Security Tax Withholding Social Social Security Taxable learn how to request federal tax withholding from your social security benefit payment when you apply or change your status. you must pay taxes on up to 85% of your social security benefits if you file a: learn how to calculate your combined income and find out if you have to pay federal income taxes on your. Social Security Taxable.

From lexiqphaedra.pages.dev

Social Security Wage Base 2024 Inflation Taxable Anne Fanchette Social Security Taxable learn how federal and state taxes affect your social security benefits based on your income level and filing. Federal tax return as an “individual” and your. learn how to request federal tax withholding from your social security benefit payment when you apply or change your status. under legislation enacted in 1983, the social security trust funds receive. Social Security Taxable.

From www.taxablesocialsecurity.com

2023 Worksheet To Calculate Taxable Social Security Social Security Taxable Federal tax return as an “individual” and your. learn how to request federal tax withholding from your social security benefit payment when you apply or change your status. if your social security income is taxable, the amount you pay will depend on your total combined retirement. learn how to calculate your combined income and find out if. Social Security Taxable.

From learningmediafiloplume.z14.web.core.windows.net

Taxable Social Security Worksheet 2022 Social Security Taxable learn how federal and state taxes affect your social security benefits based on your income level and filing. you must pay taxes on up to 85% of your social security benefits if you file a: Federal tax return as an “individual” and your. learn how to request federal tax withholding from your social security benefit payment when. Social Security Taxable.

From lessoncampusdenebola.z21.web.core.windows.net

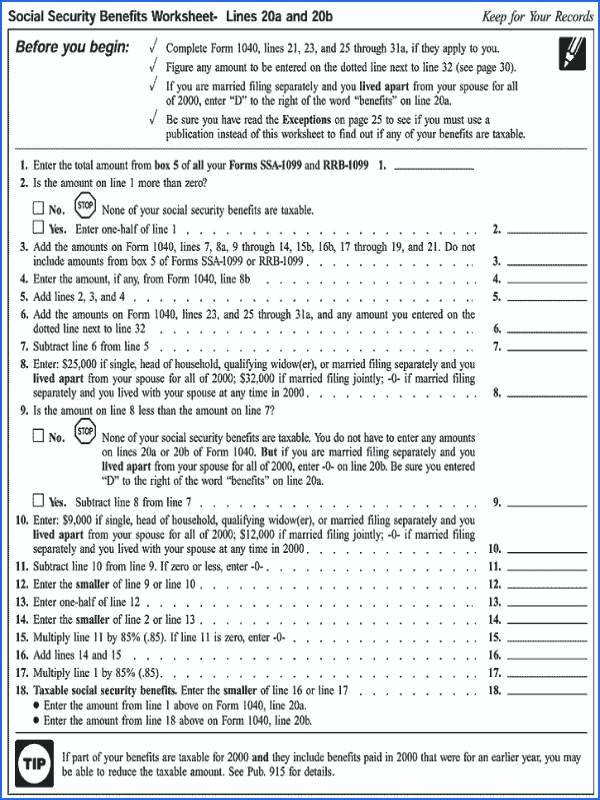

Taxable Social Security Benefits Worksheet Social Security Taxable learn how to calculate your combined income and find out if you have to pay federal income taxes on your social. under legislation enacted in 1983, the social security trust funds receive income based on federal income taxation of benefits. if your social security income is taxable, the amount you pay will depend on your total combined. Social Security Taxable.

From linnsigrid.pages.dev

Social Security Maximum Taxable Earnings 2024 Uk Hannie Ottilie Social Security Taxable you must pay taxes on up to 85% of your social security benefits if you file a: under legislation enacted in 1983, the social security trust funds receive income based on federal income taxation of benefits. learn how to determine if your social security benefits are taxable income and how to report them on your tax return.. Social Security Taxable.

From retiregenz.com

When Is Social Security Benefits Taxable 2013? Retire Gen Z Social Security Taxable under legislation enacted in 1983, the social security trust funds receive income based on federal income taxation of benefits. if your social security income is taxable, the amount you pay will depend on your total combined retirement. learn how to request federal tax withholding from your social security benefit payment when you apply or change your status.. Social Security Taxable.

From retiregenz.com

How Much Of My Social Security Is Taxable In 2021? Retire Gen Z Social Security Taxable Federal tax return as an “individual” and your. you must pay taxes on up to 85% of your social security benefits if you file a: learn how to calculate your combined income and find out if you have to pay federal income taxes on your social. if your social security income is taxable, the amount you pay. Social Security Taxable.

From worksheetzoneclivia.z14.web.core.windows.net

Taxable Social Security Worksheet 2024 Social Security Taxable learn how to request federal tax withholding from your social security benefit payment when you apply or change your status. learn how to determine if your social security benefits are taxable income and how to report them on your tax return. if your social security income is taxable, the amount you pay will depend on your total. Social Security Taxable.

From eveyguglielma.pages.dev

Social Security Tax Rate 2024 Calculator Ula Roselia Social Security Taxable learn how to determine if your social security benefits are taxable income and how to report them on your tax return. if your social security income is taxable, the amount you pay will depend on your total combined retirement. learn how to request federal tax withholding from your social security benefit payment when you apply or change. Social Security Taxable.

From retiregenz.com

What Is Taxable Social Security Benefits? Retire Gen Z Social Security Taxable learn how to calculate your combined income and find out if you have to pay federal income taxes on your social. learn how to determine if your social security benefits are taxable income and how to report them on your tax return. Federal tax return as an “individual” and your. you must pay taxes on up to. Social Security Taxable.

From worksheetrecycled.z5.web.core.windows.net

Social Security Taxable Amount Worksheet 2022 Social Security Taxable you must pay taxes on up to 85% of your social security benefits if you file a: if your social security income is taxable, the amount you pay will depend on your total combined retirement. learn how to calculate your combined income and find out if you have to pay federal income taxes on your social. Web. Social Security Taxable.

From www.taxablesocialsecurity.com

How Much Social Security Taxable Social Security Taxable learn how to determine if your social security benefits are taxable income and how to report them on your tax return. if your social security income is taxable, the amount you pay will depend on your total combined retirement. learn how federal and state taxes affect your social security benefits based on your income level and filing.. Social Security Taxable.

From ranaldbraiden.blogspot.com

Ssdi taxable calculator RanaldBraiden Social Security Taxable learn how to request federal tax withholding from your social security benefit payment when you apply or change your status. learn how to determine if your social security benefits are taxable income and how to report them on your tax return. learn how federal and state taxes affect your social security benefits based on your income level. Social Security Taxable.

From merylmoreen.pages.dev

Max Taxable Social Security Wages 2024 Ny Berthe Rafaelita Social Security Taxable if your social security income is taxable, the amount you pay will depend on your total combined retirement. you must pay taxes on up to 85% of your social security benefits if you file a: under legislation enacted in 1983, the social security trust funds receive income based on federal income taxation of benefits. Federal tax return. Social Security Taxable.

From skloff.com

Does Your State Tax Social Security Benefits? 2021 Skloff Financial Group Social Security Taxable learn how to calculate your combined income and find out if you have to pay federal income taxes on your social. if your social security income is taxable, the amount you pay will depend on your total combined retirement. Federal tax return as an “individual” and your. learn how to request federal tax withholding from your social. Social Security Taxable.